SUMTERVILLE INDUSTRIAL DEALS NOW

- $6,500,000

SUMTERVILLE INDUSTRIAL DEALS NOW

- $6,500,000

Description

INDUSTRIAL PROPERTY SHOWCASE – BUILD-TO-SUIT – SAMPLE TILT-WALL PROJECT IN PROGRESS

| 2499 N US-301 E Sumterville, FL 33585 26,316 SF 4-Star Industrial Building $6,500,000 ($247.00/SF) |

Sumterville – Tilt-Wall New Build Project

2499 N US-301 E | Sumterville Tilt-Wall Park | 26,316 SF (Proposed) | $6,500,000 ($247/SF)

Executive Summary

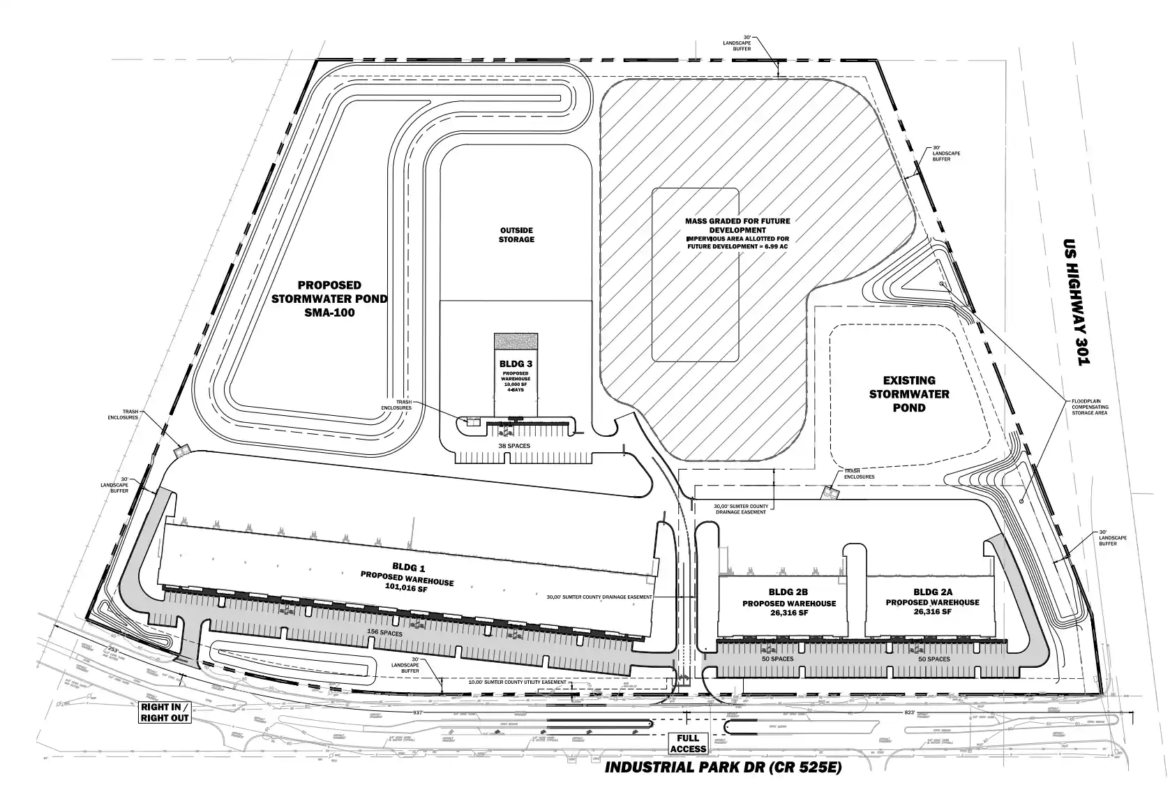

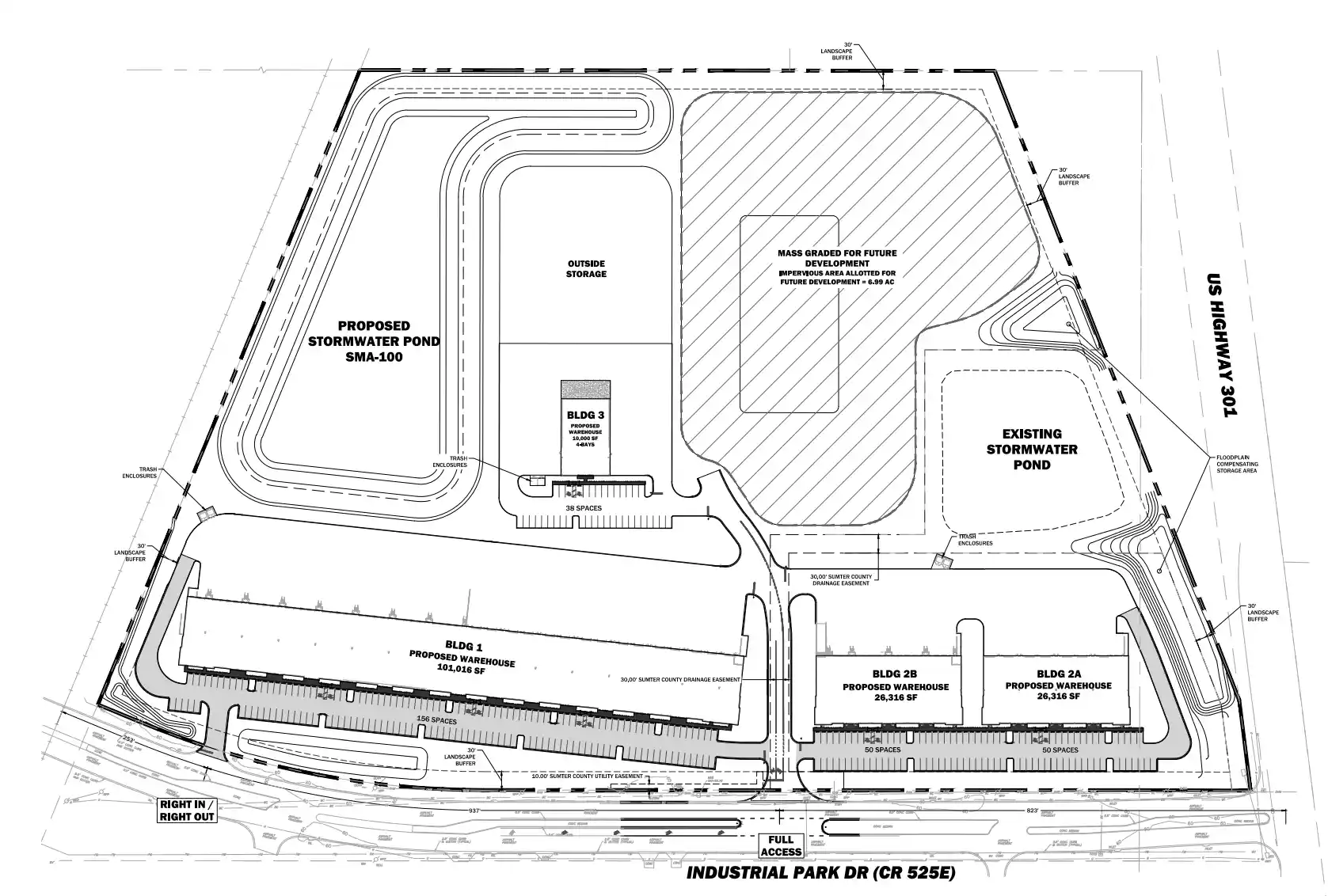

This is not a pie-in-the-sky concept. It is a concrete plan — literally. The proposed 26,316 square foot tilt-wall industrial project at 2499 N US-301 E in Sumterville offers a developer the rare combination of institutional-sized scale and fast-to-market construction technology. Priced at $6,500,000 and designed with 3,000 SF minimum bays, 24’–26′ clear heights, 13 dock-high doors, and one drive-in door, this building is engineered to serve logistics, distribution, cold chain adjuncts, and multi-bay light industrial users. The developer also offers the option to include outside storage, adding operational flexibility and revenue potential.

If you are a capitalist weighing where to deploy capital, listen closely: this is a ground-floor opportunity to sponsor new institutional-grade industrial product in a market that rewards scale, speed, and resilience. Tilt-wall construction isn’t just a method — it’s a formula for getting income-producing real estate into service sooner, with durability baked into every panel.

Why Tilt-Wall Construction / Investment Highlights

• Fast-to-Cashflow Advantage — Tilt-wall panels are cast on-site and lifted into place, compressing the critical path. Faster erection means an earlier lease-up window and quicker stabilization of returns.

• Durability and Low Maintenance — Solid concrete panels resist weather, insect, and fire damage in ways light-gauge metal buildings do not. That durability reduces lifecycle repair costs and underwriting risk.

• High-Image, Institutional Finish — Tilt-wall facades look finished from day one; they convey quality to tenants and institutional buyers, supporting higher re-leasing velocity and stronger resale exit multiples.

• Thermal & Acoustic Benefits — Concrete panels provide significant mass, improving temperature stability and reducing noise — a seller point for tenants who value climate resiliency and an indoor working environment.

• Design Flexibility at Scale — Large clear spans and 24’–26′ clear heights allow efficient racking, mezzanine additions, cross-docking, or hybrid office/showroom layouts; minimum 3,000 SF bay sizing attracts both small-bay users and national tenants needing contiguous blocks.

• Insurance & Resilience Perks — When combined with modern glazing and proper roofing systems, tilt-wall buildings can achieve lower long-term insurance volatility in storm-prone regions versus older, lighter structures.

• Revenue Upside — Outside storage capability and multiple loading points (13 dock-high doors + 1 grade door) create premium functional options for users who will pay for convenience and throughput.

Proposed Property Construction Details — clean specs

• Price: $6,500,000 ($247.00/SF)

• Construction Status: Proposed (developer will build)

• Rentable Building Area: 26,316 SF

• Minimum Bay Size: 3,000 SF (flexible bay demising)

• Clear Ceiling Height: 24’ to 26’ (designed for industrial racking and warehouse systems)

• Number of Dock-High Doors: 13

• Drive-In / Grade-Level Doors: 1

• Building Class: A (new construction)

• No. of Stories: 1

• Lot Size: 2.85 Acres (campus-style footprint with room for circulation and outside storage)

• Zoning: Industrial

• Operating Expenses / Taxes (projected/actual pro forma): Total Expenses shown $99,999; Per SF $9.99 (useful for underwriting operating cost assumptions)

• Developer Options: Buildings can be constructed with outside storage; unit demising and fit-out packages available per tenant needs

• Expected Core Systems: tilt-wall insulated panels, high-efficiency roofing, LED exterior lighting, modern dock equipment provisions, basic site utilities and drainage to institutional standards

Strategic Angle — why now and why this project matters

You are not buying a building figure on a spreadsheet; you are buying tempo and optionality. The Sumterville location sits along an arterial freight corridor with direct access to U.S.-301, and it sits within a regional trade web that feeds Central Florida’s distribution network. New construction of this scale in this submarket creates supply where small-bay vacancy structurally limits tenant options. That supply gap is precisely what drives pre-leasing activity and rent capture for well-specified product.

Tilt-wall gives you monetary and competitive advantages: it shortens the calendar (less time between groundbreak and income), it produces a finished, institutional-grade asset that leases faster to credit and regional users, and it lowers lifecycle maintenance for long-term holders. For capital partners who prefer sponsoring product that can convert from spec to credit leases quickly, this project reads like a checklist of priority items: institutional class, efficient bays, strong loading geometry (13 docks), and optional outdoor storage for users in trades that need staging.

Think also about buyer appetite on exit. Institutional and private-equity buyers underwrite to stable, low-capex assets; tilt-wall buildings check those boxes. You build in a way that prospective purchasers will value. That matters if your strategy is to develop and sell into an institutional bid or to stabilize and hold with attractive cash yield.

This project is engineered for multiple paths to return: pre-lease the bulk to regional operators; deliver shell space for value-add tenant improvements; or package the finished asset and market it to long-term holders. Each path benefits from the same core assets: controlled construction cost predictability, robust utility for tenants, and an address that supports logistics efficiency.

A few pragmatic points for capitalists to consider now:

• Schedule certainty matters. Tilt-wall production reduces weather delays for exterior completion and allows internal trades to proceed earlier. Shorter schedules mean less interest carry and earlier NOI.

• Tenant selection is key. Minimum 3,000 SF bays attract local and regional operators; grouping bays enables mid-size distribution tenants to scale in-place. Pre-leasing to a mix of credit and regional tenants balances immediate cash flow with upside on vacant industrial rents.

• Value engineering should focus on efficient dock spacing, durable roofing systems, and utility provisions that support tenants’ HVAC and electrical demands while keeping base shells attractive to future buyers.

• Site plan optionality (outside storage) has tangible payoff with certain tenant types (aggregators, landscaping, contractor staging), translating to incremental rent or separate storage lease revenue.

Bottom Line — a direct call to the decisive capitalist

Here is the simple calculus: you can fund another marginal play, or you can back a project that combines speed, durability, and institutional appeal. At $6.5M for a 26,316 SF tilt-wall industrial building with 3,000 SF minimum bays, 24’–26′ clear heights, 13 dock doors, outside storage option, and predictable operating expense assumptions, you are buying a platform that accelerates income and minimizes long-term capex surprises.

If you hesitate because the perfect deal may never come, remember: winners don’t wait for the mythical ideal. Winners identify asymmetric advantages and move. Tilt-wall construction gives you three such advantages at once — faster delivery, lower long-term upkeep, and a high-quality building that institutional buyers prize. Combine that with the project’s loading geometry and bay sizing, and you have a developer’s product that underwrites well for pre-lease scenarios or a high-probability sale to private capital.

Make the call on a project that’s engineered to turn concrete panels into cashflow. Build with speed. Lease with certainty. Exit with optionality. This is the moment to translate capital into an industrial asset that performs from day one. Step forward; tilt the market in your favor.

Links

Argossy International Properties

Sumter County Economic Development

Transportation Snapshot

• Cargo Air – United Airlines Cargo, Tampa: 1 hr 8 min (72.3 mi) via I-75 S and I-275 S

• Cargo Rail – Saddle Creek Corp. Orlando FL: 52 miles, approx. 65 minutes.

• Cargo Port – Port of Tampa Bay: 71 miles, approx. 88 minutes.

Listing Courtesy of Chuck McNulty, McNulty Group Incorporated

Address

Open on Google Maps- Address: 2499 N US-301 E Sumterville, FL 33585

- Zip/Postal Code: 33585

Contact Information

View Listings- Argossy International Properties

- 760-507-1222

Enquire About This Property

- Argossy International Properties